Mortgage How to Make For many people, purchasing a home is one of life’s most significant milestones. A mortgage is a type of loan that allows individuals to finance the purchase of real estate, typically a home or other property. Given the complexity of mortgages and the long-term financial commitment they entail, understanding the basics is crucial. This comprehensive guide will explore what a mortgage is, the different types, key considerations, and tips for choosing the right mortgage for your needs.

What is a mortgage?

A mortgage is a loan used to finance the purchase of real estate, with the property itself serving as collateral. The borrower consents to pay back the loan plus interest over a predetermined time frame, usually 15 to 30 years. If the borrower fails to make payments, the lender has the right to foreclose and take possession of the property.

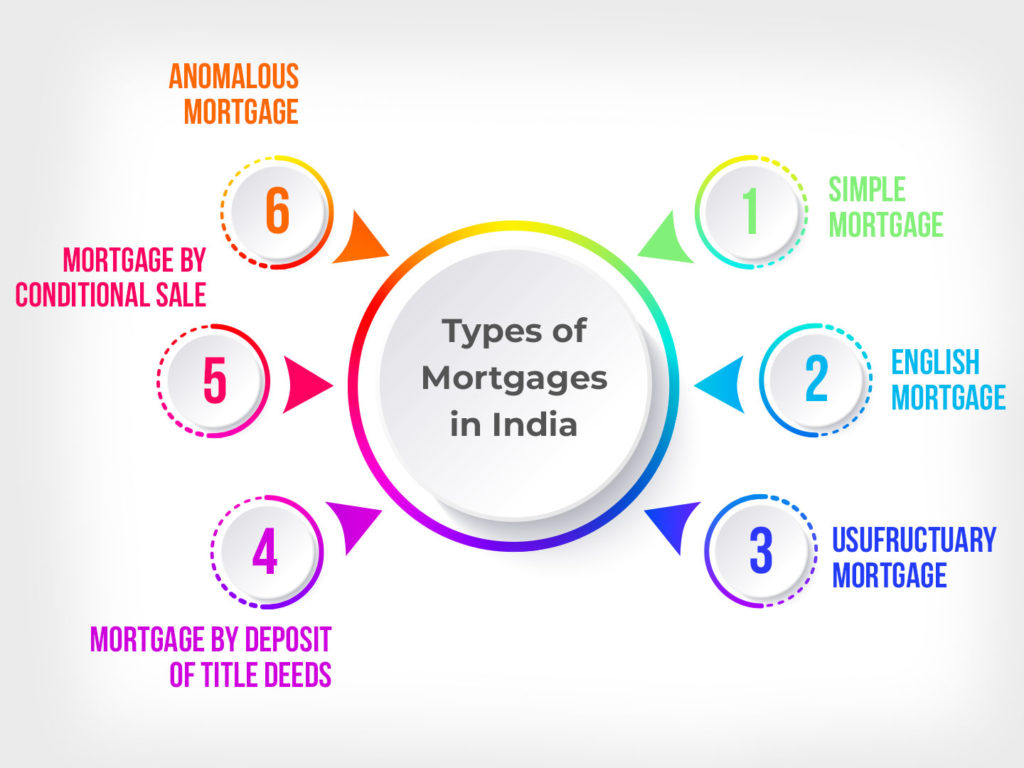

Types of Mortgage

Mortgages come in various forms, each designed to meet different needs and circumstances. Understanding the different types can help you choose the right mortgage for your situation.

Fixed-Rate Mortgage: This type of mortgage has a fixed interest rate that remains constant throughout the loan term. Mortgage How to Make It provides stability and predictability in monthly payments, making it a popular choice for many homeowners.

Adjustable-Rate Mortgage (ARM): With an ARM, the interest rate can fluctuate based on market conditions after an initial fixed period. For example, a 5/1 ARM has a fixed rate for the first five years and then adjusts annually. Mortgage ARMs often start with lower rates but carry the risk of rate increases over time.

Interest-Only Mortgage: In this type of mortgage, the borrower pays only the interest for a specified period, after which they start paying both principal and interest. This can result in lower initial payments but may lead to higher costs later.

Balloon Mortgage: A balloon mortgage has low monthly payments for a set period, followed by a large “balloon” payment at the end of the term. This type of mortgage can be risky if the borrower cannot make the final payment.

Government-Backed Mortgages: But These mortgages are guaranteed or insured by government organizations like the United States Department of Agriculture (USDA), the Department of Veterans Affairs (VA), or the Federal Housing Administration (FHA). They often have lower down payment requirements and are designed to help specific groups, like first-time buyers or veterans.

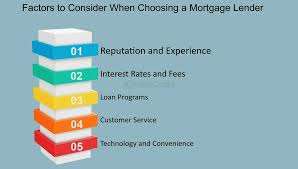

Important Things to Think About When Selecting a Mortgage

Choosing the right mortgage involves assessing your financial situation, goals, and risk tolerance. The following are some crucial points to consider:

Interest Rate: The interest rate affects your monthly payments and total loan cost. Fixed-rate mortgages offer stability, while ARMs can provide lower initial rates with the risk of future increases.

Loan Term: But The length of the loan term impacts your monthly payments and the total interest you’ll pay. Longer terms (like 30 years) generally result in lower monthly payments, while shorter terms (like 15 years) can save on interest costs.

Down Payment: The down payment is the initial payment you make toward the property. Higher down payments can lower your loan amount and interest rate, while lower down payments may require mortgage insurance.

Closing Costs: These are fees associated with finalizing , including origination fees, appraisal costs, and title insurance. Make sure to include these in your spending plan.

Prepayment Penalties: Early repayment may be subject to penalties. Check your mortgage agreement to see if this applies to you.

Tips for Obtaining

Securing a mortgage requires careful planning and preparation. Here are some pointers to assist you with the procedure:

Check Your Credit Score: Your credit score plays a significant role in determining your mortgage terms. Before applying, check your credit score and address any issues to improve your chances of approval and secure better rates.

Determine Your Budget: But Calculate how much you can afford for a down payment and monthly mortgage payments. Include other homeownership costs, such as property taxes, insurance, and maintenance.

Compare Lenders: Different lenders have varying terms and rates. Shop around.. Obtain quotes from multiple lenders to compare options and find the best deal.

Get Pre-Approved: A pre-approval from a lender gives you an estimated loan amount and demonstrates to sellers that you’re a serious buyer. It can also speed up the mortgage process when you find a property.

Work with a Mortgage Professional: A mortgage broker or loan officer can guide you through the process, help you understand your options, and assist with paperwork.

Finally

A mortgage is a powerful tool for financing the purchase of a home, but it comes with a significant financial commitment. By understanding the different types of mortgages, key considerations, and tips for obtaining a mortgage, you can make informed decisions that align with your financial goals.

For additional information on mortgages, homebuying, and real estate, visit our website, where you’ll find expert advice, mortgage calculators, and other valuable resources. Whether you’re a first-time homebuyer or looking to refinance. We’re here to help you navigate the mortgage process with confidence.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.