A Beginner’s Guide to Understanding Financial Concepts

Finance is a fundamental aspect of our lives, influencing everything from personal budgeting to global economic systems. Yet, for many, the world of finance can seem complex and intimidating. In this beginner’s guide, we will demystify finance by breaking down key concepts in a clear and easy-to-understand manner, empowering you to navigate the financial landscape with confidence.

Understanding Financial Basics:

Finance is essentially the management of assets and money. It encompasses a wide range of activities, including budgeting, investing, borrowing, and managing risk. By understanding the basic principles of finance, you can make informed decisions to achieve your financial goals and secure your financial future.

Budgeting:

Budgeting is the foundation of financial planning. It entails keeping track of your earnings and outlays to make sure you are conserving money for the future and living within your means. A budget typically includes categories such as housing, transportation, groceries, and entertainment. By creating a budget and sticking to it, you can avoid overspending and build wealth over time.

Saving and Investing:

Saving and investing are essential components of building long-term financial security. It involves setting aside a portion of your income for future use, such as emergencies or retirement. Investing, on the other hand, involves putting your money to work to generate returns over time. But Real estate, mutual funds, equities, and bonds are examples of common investment possibilities. By investing wisely, you can grow your wealth and achieve your financial goals faster.

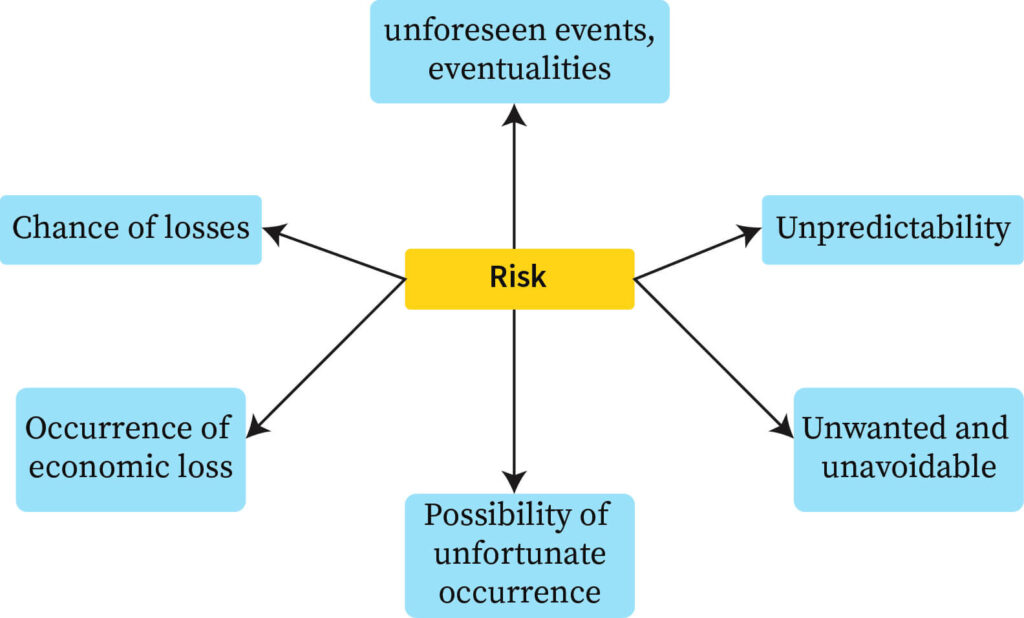

Understanding Risk and Return:

Risk and return are fundamental concepts in finance. But Risk refers to the uncertainty associated with an investment, including the possibility of losing money. Conversely, return refers to the financial gain made from an investment. Generally, investments with higher risk offer the potential for higher returns, while investments with lower risk offer lower returns. It’s important to carefully consider your risk tolerance and investment objectives when making investment decisions.

Managing Debt in Finance:

Debt is a common financial tool that allows individuals and businesses to borrow money to finance purchases or investments. While debt can be useful, it can also be a source of financial stress if not managed properly. But It’s important to understand the different types of debt, such as credit cards, mortgages, and student loans, and develop a plan to pay off debt efficiently. By reducing debt and managing interest costs, you can improve your financial health and build wealth over time.

Understanding Financial Markets:

Financial markets play a crucial role in the global economy, facilitating the buying and selling of financial assets such as stocks, bonds, and currencies. Financial markets come in a variety of forms, such as stock, bond, and foreign exchange markets.. But These markets provide liquidity, price discovery, and risk management for investors and businesses around the world.

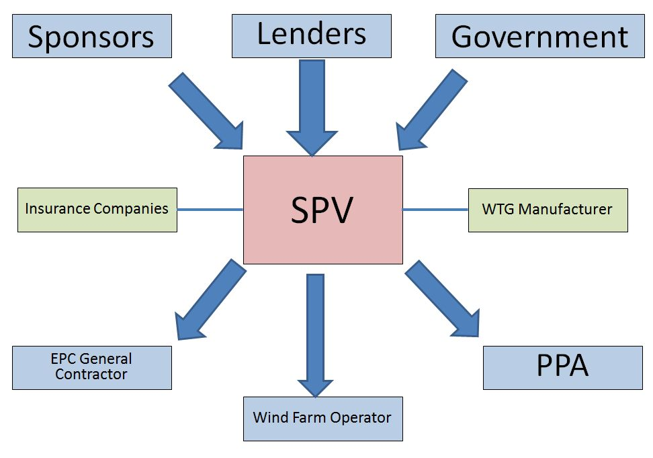

Key Players in Finance:

There are several key players in the world of finance, each playing a unique role in the financial system. These include:

Banks: Banks are financial institutions that accept deposits and make loans to individuals and businesses. They also provide a wide range of financial services, including savings accounts, checking accounts, and loans.

Investment Firms: Investment firms manage and invest money on behalf of clients, including individuals, institutions, and governments. These firms may offer services such as investment management, financial planning, and retirement planning.

Insurance Companies: Insurance companies provide financial protection against risks such as accidents, illnesses, and natural disasters. They collect premiums from policyholders and pay out claims when covered events occur.

Central Banks: Central banks are responsible for regulating the monetary system and controlling the supply of money in the economy. They also play a key role in setting interest rates and maintaining financial stability.

Government Agencies: Government agencies regulate and oversee various aspects of the financial system, including banking, securities markets, and consumer protection. These agencies enforce rules and regulations to ensure the integrity and stability of the financial system.

Financial Planning:

Financial planning is the process of setting financial goals, developing a plan to achieve those goals, and monitoring progress over time. A comprehensive financial plan may include elements such as budgeting, saving, investing, insurance, and estate planning. By creating a financial plan tailored to your individual needs and circumstances, you can build a secure financial future for yourself and your family.

Common Financial Terms:

To navigate the world of finance effectively, it’s helpful to familiarize yourself with common financial terms and concepts. Some key terms to know include:

Asset: An asset is anything of value that you own, such as cash, investments, real estate, or personal property.

Liability: A liability is a financial obligation or debt that you owe to someone else, such as a mortgage, car loan, or credit card debt.

Equity: Equity is the difference between the value of an asset and the amount of any liabilities associated with it. It represents your ownership stake in an asset.

Interest is the fee associated with borrowing money or the profit on an investment. Usually, it is stated as a percentage of the main sum.

Spreading assets over several asset classes, industries, and geographical areas is known as diversification. This risk management technique helps to lower exposure to any one risk.

Compound Interest: Interest that is computed on both the original principal and the interest accrued over time is known as compound interest. It allows investments to grow exponentially over time.

Conclusion:

Finally Finance

Finance is a broad and multifaceted field that touches nearly every aspect of our lives. By understanding the basic principles of finance, you can make informed decisions to achieve your financial goals and secure your financial future. Whether you’re budgeting, saving, investing, or planning for retirement, the concepts outlined in this guide will empower you to navigate the financial landscape with confidence. Remember, financial success is within reach for anyone willing to take the time to learn and apply sound financial principles.