Loans are a common financial tool that allows individuals and businesses to borrow money with the agreement to repay it, typically with interest, over a specified period. Loans can be a practical solution when you need funds for significant expenses like purchasing a home, paying for education, starting a business, or handling emergencies. However, understanding the basics of Credits and the various types available is crucial for making informed financial decisions. This comprehensive guide will help you navigate the world of loans and borrow wisely.

What is a loan?

A loan is a financial agreement in which a lender provides money to a borrower with the expectation that it will be repaid, often with interest. The terms of the loan, including the loan amount, interest rate, repayment schedule, and other conditions, are typically outline in a contract or promissory note.

Types of loans

There are various types of Credits, each designed for specific purposes. Understanding the differences between them is essential for choosing the right loan for your needs. Here are a few typical loan kinds:

Personal Credits: These loans are typically unsecure (not backed by collateral) and can be used for various purposes, such as debt consolidation, home improvements, medical expenses, or personal projects. Personal loans usually have fixed interest rates and repayment periods.

Mortgage Loans: These are use to finance the purchase of real estate, such as a home or commercial property. But Mortgage Credits are secure by the property itself, which serves as collateral. They typically have longer repayment terms, often 15 to 30 years.

Auto Loans: Used to purchase a vehicle, auto loans are secure by the vehicle, which means the lender can repossess it if the borrower defaults. These Credits usually have shorter terms compared to mortgages, often ranging from three to seven years.

Student Loans: Design to help students cover the cost of education, student Credits can be issue by the government or private lenders. They often have unique repayment terms, such as deferred payments while the borrower is in school.

Business Loans: These loans are intended to finance business operations, expansion, or equipment purchases Depending on the lender and the borrower’s creditworthiness, they may be secured or unsecured.

Home Equity Credits and Lines of Credit (HELOCs): Home equity loans allow homeowners to borrow against the equity in their homes. These loans can be used for major expenses or renovations. HELOCs function like a credit card, allowing you to borrow as needed up to a certain limit.

Key Factors to Consider When Taking a Loan

Before taking out a loan, it’s important to consider several key factors to ensure you make a sound financial decision:

Interest Rate: This is the cost of borrowing, expressed as a percentage of the loan amount. Fixed interest rates remain constant throughout the loan term, while variable rates can fluctuate.. Examine prices to get the finest offer.

Longer terms usually result in lower monthly payments but higher total interest costs.

Fees and Penalties: Some loans come with additional fees, such as origination fees, application fees, or prepayment penalties. Make sure you are aware of any related expenses.

Collateral: If the loan is secured, determine what collateral is required and what risks you face if you default.

Credit Score: Your credit score plays a significant role in determining your loan eligibility and interest rate. Higher credit scores typically lead to better loan terms.

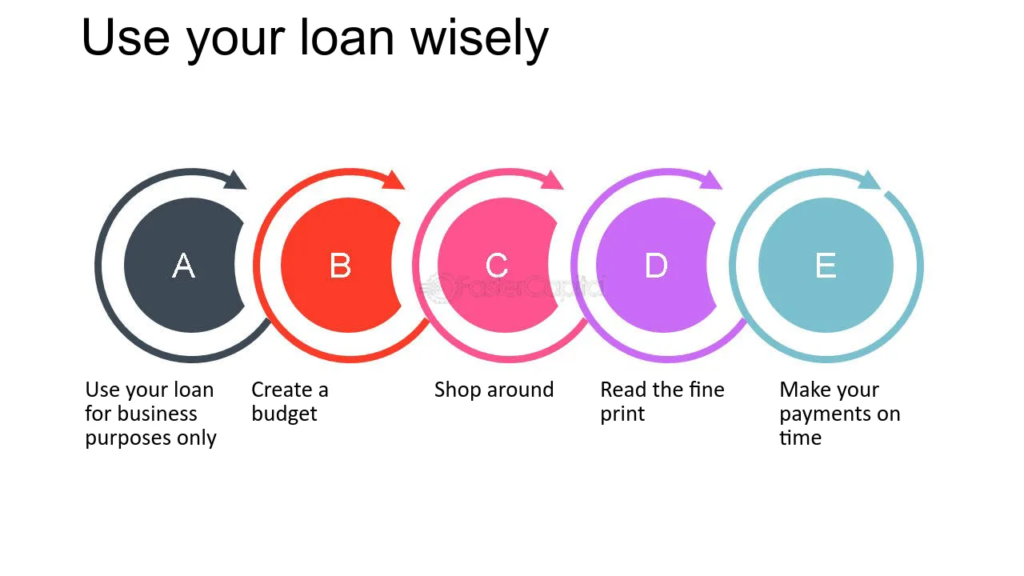

Tips for Borrowing Wisely

To ensure you borrow wisely and avoid potential pitfalls, follow these tips:

Borrow Only What You Need: Avoid borrowing more than necessary to minimize your debt burden and interest costs.

Shop Around for the Best Rates: Different lenders offer different terms. Get multiple quotes and compare interest rates, fees, and other conditions.

Read the Fine Print: Always read the loan agreement carefully to understand all terms and conditions. Ask questions if anything is confusing.

Create a Repayment Plan: Before taking out a loan, determine how you will repay it. Include loan payments in your budget and ensure you can meet the monthly obligations.

Consider Alternatives to Borrowing: Sometimes, there may be other options, such as saving up for a purchase or seeking financial assistance from family or friends.

Finally Loans free life

Loans can be valuable tools for financing significant expenses and achieving personal or business goals. However, it’s essential to understand the different types of loans and carefully consider the terms, interest rates, and other factors before borrowing. By borrowing wisely, you can avoid unnecessary debt and financial stress.

For more information on loans, lending practices, and financial management, visit our website, where you’ll find additional resources, tips, and expert advice. Whether you’re considering a personal Credits, mortgage, or business loan, we’re here to help you make the best financial choices.