Understanding Insurance, Insurance is an essential part of modern life, providing a safety net for individuals, families, and businesses. It is a contract between an insurer and an insured, where the insurer agrees to compensate the insured for specified losses in exchange for a premium. Whether it’s health, auto, home, or life insurance, the goal is the same: to provide financial protection against unexpected events. This comprehensive guide aims to help you understand the basics of insurance and how it can help you protect your future.

Why insurance matters

Life is unpredictable. Natural disasters, accidents, illnesses, and other unforeseen events can have a significant financial impact. Insurance is designed to mitigate these risks, allowing you to recover from losses without significant financial hardship. It also provides peace of mind, knowing that you’re protected against the unknown.

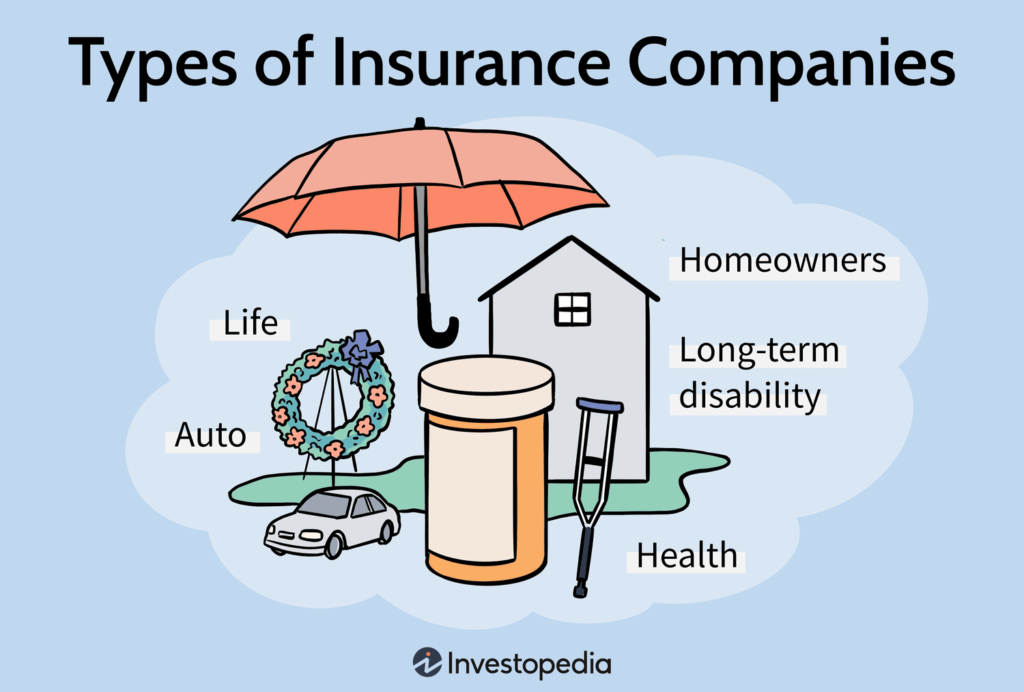

Types of insurance

Insurance comes in many forms, each designed to cover specific risks. Here are some of the most common types of insurance and what they cover:

Health insurance covers medical expenses related to illness, injury, and preventative care. It can also include coverage for hospitalization, surgeries, and prescription medications.

Auto insurance protects against financial loss in the event of a car accident, theft, or damage to your vehicle. It can also cover liability for injuries or damage caused by your vehicle.

Home insurance covers damage to your home and personal belongings from events like fire, theft, or natural disasters. It often includes liability coverage for accidents that occur on your property.

When you pass away, life insurance gives your beneficiaries financial support.. This can be critical for providing for your loved ones and covering final expenses.

Disability insurance offers income replacement if you’re unable to work due to injury or illness.

Travel insurance covers unexpected events while traveling, such as trip cancellations, lost luggage, or medical emergencies.

How Insurance Works

Insurance operates on the principle of risk-pooling. Policyholders pay premiums into a shared fund, which is then used to pay claims for those who experience covered losses. Understanding Insurance By spreading the risk among many policyholders, insurance companies can offer protection against significant financial losses.

You and the insurer get into a contract when you buy an insurance policy. Understanding Insurance The policy outlines the terms and conditions, including what is covered, what is excluded, the premium amount, and the deductible (the amount you must pay before the insurance coverage kicks in). It’s crucial to read and understand your policy to know what you’re entitled to and what responsibilities you have.

Understanding Insurance Choosing the right insurance

Choosing the right insurance policy depends on your individual needs and circumstances. Here are some key considerations when selecting insurance:

Assess Your Risks: Identify the risks you want to cover. For instance, purchasing life insurance could be essential if you have a family.. If you own a car, auto insurance is essential.

Compare Policies: Look at different policies and compare their coverage, costs, deductibles, and exclusions. Make sure the policy you choose aligns with your needs and budget.

Check the insurance company’s reputation: Research the insurance company’s financial stability and customer reviews. You want to choose an insurer with a good track record of paying claims and providing quality customer service.

Consult an Insurance Agent or Broker: An insurance agent can help you understand your options and find the right policy for you. They can also explain complex terms and guide you through the application process.

Maximizing the Value of Your Insurance

To get the most value from your insurance, consider the following tips:

Review your policies regularly. Life changes can affect your insurance needs. Every year, check if your policies still satisfy your needs.

Bundle Policies: Many insurers offer discounts if you bundle multiple policies, such as auto and home insurance.

Practice Preventative Measures: By reducing risks (e.g., installing smoke detectors or maintaining your car), you may qualify for lower premiums.

Understand Your Deductible: Choose a deductible that balances your premium cost and out-of-pocket expenses. A higher deductible typically means a lower premium, but it also means you’ll pay more in the event of a claim.

Results Understanding Insurance

Insurance is a vital tool for protecting yourself and your loved ones from unexpected events. By understanding the different types of insurance, how they work, and how to choose the right policies, you can make informed decisions to safeguard your future. Whether it’s health, auto, home, or life insurance, having the right coverage can provide financial security and peace of mind.

For more information and personalized advice, visit our website, where you’ll find additional resources, expert insights, and tools to help you make the best insurance choices for your needs. Protect your future with the right insurance today.